Weekly Reading Recommendations

The State of America's Wallet & Health of Consumer (WSJ)

Interest Rate Cuts: What They Mean For You (Callie Cox)

Global Diversification Benefits Investors as Chinese Stocks Charge Into Bull Market (Yahoo Finance)

5 Tips to Retire 5 Years Early (Fidelity)

—————————————————————————————————————————

This Week's Highlight Article

Confusing Economic Signals

Headlines about the U.S. economy often seem contradictory, with a quick search revealing a range of opinions. Amid the noise, "doomsday" recession predictions tend to dominate because fear grabs attention, helping media outlets increase clicks and ad revenue. This is one reason Legacy launched its "What We're Reading" newsletter in 2017—to shift focus to what truly matters and cut through the noise.

This week's highlighted article explores the current economic confusion and the difficulties of assessing economic health in real time; providing some fascinating statistics throughout.

Click Here to Read, "Confusing Economic Signs"

Last, but not least, even if the pessimistic views on the economy unfold (eventually, they will - as we often say, if we're not in a recession we're heading towards one; thus is the cyclical nature of an economy), the history of the stock market shows that stock returns have often been positive during recessions - the cumulative return on the US market was positive in 12 out of 16 two-year periods that began at the onset of a recession as highlighted in the following article:

Charts that matter

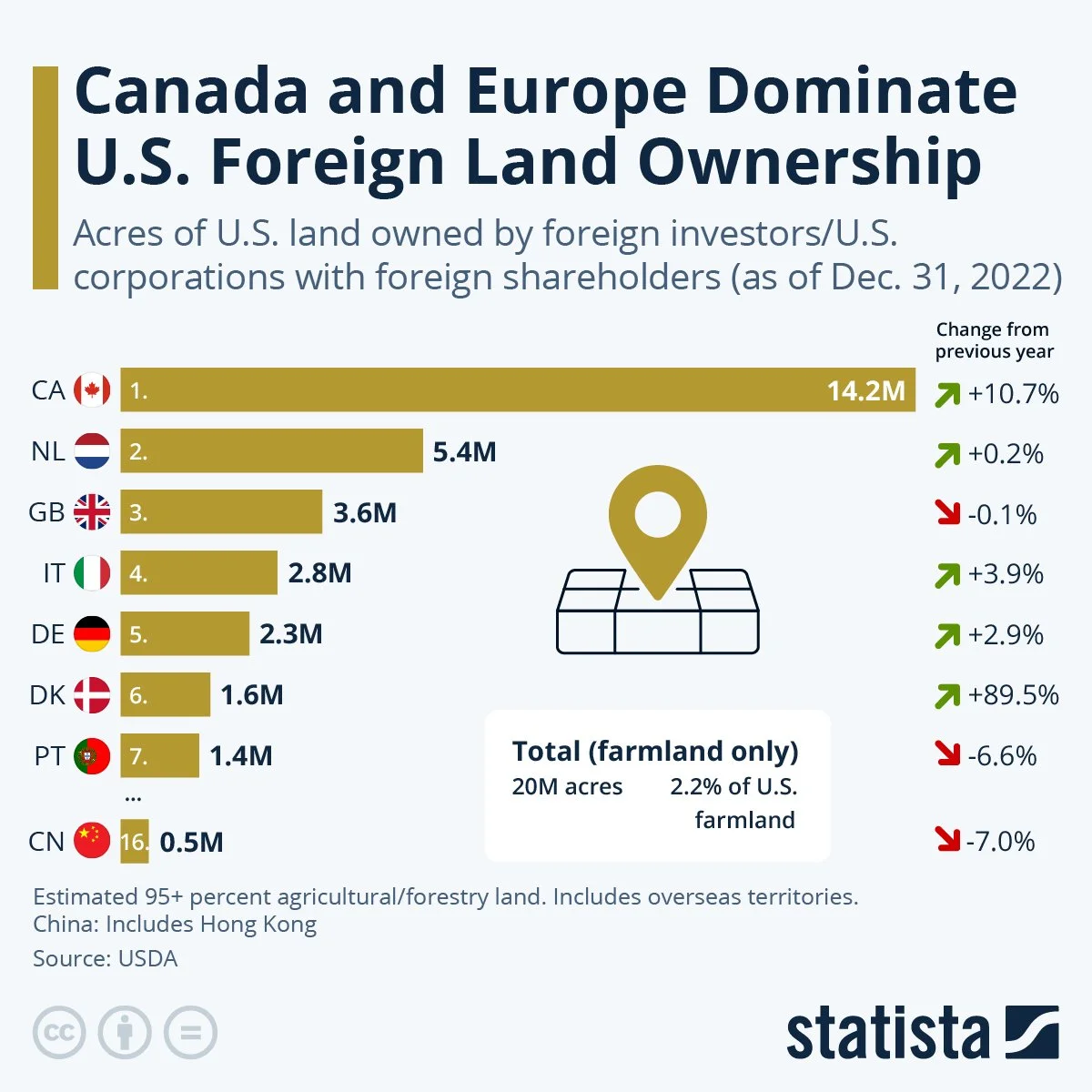

U.S. Land Owned by Foreign Investors

There have been several headlines over the past few years about foreigners, China in particular, buying up land in the U.S. This week's chart provides a look at foreign land ownership; with China ranking #16, far behind Canada and even the Cayman Islands. Diving a bit deeper, only 2.2% of US farmland is foreign-owned.

If we equal-weight indexes by giving each constituent company the same percentage regardless of size, it becomes obvious how much a few giant US companies are changing perceptions. What comes as a surprise to many is that on an equal-weighted basis, the total return on MSCI’s index for Europe has actually outperformed its US Index since the beginning of 2023.

Legacy Trust Family Wealth Offices

4200 Marsh Landing Blvd, Suite 100

Jacksonville Beach, FL 32250

Office: (904) 280-9100

Fax: (904) 280-9109

Legacy Trust Family Wealth Offices of Jacksonville Beach, Florida, is a new type of financial services firm - an independent multi-family office - that brings all facets of your personal financial affairs under one roof, where they are coordinated for optimum efficiency and maximum performance.

Investment products are not FDIC insured, are not bank guaranteed, and may lose value.