CHARTS THAT MATTER

As the old saying goes, a picture is often worth a thousand words. Charts are no exception and often encapsulate a powerful story.

Legacy’s Investment Team flips through hundreds of charts each quarter, handpicking those that we feel are relevant to the particular investment backdrop that you can walk through with us.

Rumors persistently circulate that the dollar is at risk of losing its reserve currency status. These rumors are stoked by the desire of China (and others) to see this happen. The U.S. is not strong because the dollar is the reserve currency, the dollar is the reserve currency because the U.S. is strong. Not just in economic might, but in its governance. The Constitution still stands, along with its protections of private property rights and the rule of law, which have created honest, deep and liquid financial markets. The U.S. remains one of the few places where people risk their lives daily to get into, not out of.

As illustrated in this week's chart, due to the United States' importance in global capital markets and international debt, the dollar is set to stick around as the world's reserve currency for the foreseeable future.

The Capex driven by the “AI Race” has clearly been historic. In fact, AI related spending has contributed to nearly 33% of economic growth (GDP) in 2025.

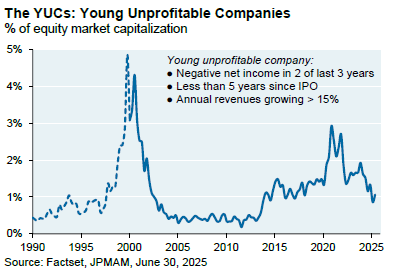

JP Morgan’s YUC Measure (YUC = young, unprofitable companies) provides a useful gauge of bull market health and irrational exuberance, and currently it looks benign. This suggests that investors are paying closer attention to fundamentals, beyond the occasional meme stock surge. Historically, the YUC measure peaked during speculative booms, including the SPAC and meme stock surge of 2021–2022, which preceded a sell-off in lower-quality stocks. It also reached a high leading up to the 2001 Dot-Com Bubble. The fact that this index has steadily declined is a net positive signal for the overall health and sustainability of the current bull market.

Market pundits and “perma-bears” love to draw parallels between current market conditions vs. the past. Current parallels are being drawn between the early 2000s “dot com” technology bubble. But highlighted in the following two charts, earnings growth data shows profits have been keeping pace with prices (unlike during the tech bubble). Returns have been driven by fundamentals not "irrantional exhuberance."

A fascinating data point on this moment in time: AI related stocks have accounted for 75% of S&P 500 returns, 80% of earnings growth and 90% of capital spending growth since ChatGPT launched in November 2022.

The chart highlights the long-term performance of equities versus short-term cash equivalents since 1999. Despite multiple market cycles—including the dot-com bubble, the 2008 financial crisis, and the COVID-19 downturn—both the Dow Jones Industrial Average and the S&P 500 Index have significantly outperformed one-month Treasury bills over time.

This demonstrates that while equities experience short-term volatility, they have consistently delivered superior total returns for long-term investors. Even during periods of heightened uncertainty, remaining invested in stocks has historically proven to be a better strategy than holding cash.

The chart illustrates the shift in U.S. import sources over the past three decades. Since the late 1980s, imports from China have grown dramatically, rising from under 3% in the early 2000s to over 10% of total U.S. imports today. In contrast, imports from the European Union and Mexico have steadily declined or remained relatively flat over the same period.

This trend reflects the globalization of supply chains and China’s emergence as a dominant manufacturing hub. However, recent fluctuations suggest potential diversification as U.S. trade policy and corporate sourcing strategies evolve.

What’s driving the above average equity market valuations here in the US? As shown in following chart, they’ve been underpinned by historically high corporate profit margins that have grown materially over the past 10 years. These robust margins, which have been particularly pronounced with technology-related companies, have helped support higher earnings multiples.

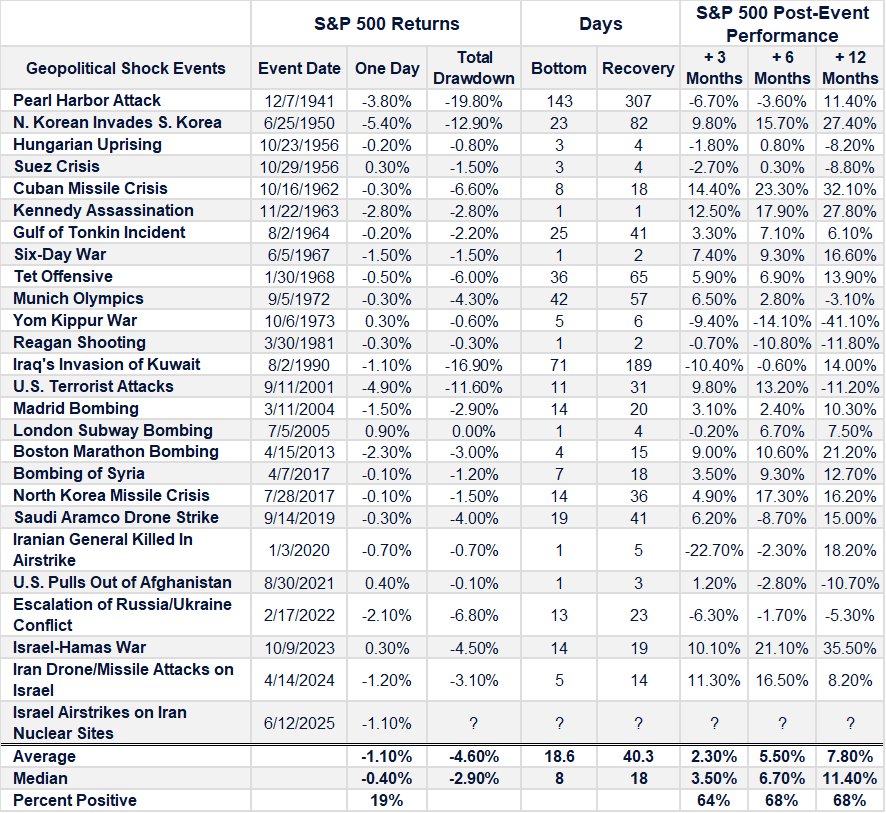

The chart illustrates the total downside (drawdown), the number of days for the markets to bottom and recover, as well as post event performance 3, 6 and 12 months out. As you can see, the markets have historically been quite resilient in the face of these shocks.

In a similar vein, some investors may be sitting out of the market due to fear that a major market decline or economic recession may be right around the corner.

“Distressing headlines can lead investors to assume the worst,” says Malwal. Headlines do occasionally spark short-term market volatility. But often the bigger risk is that by over-focusing on the negatives, investors end up missing out on opportunities and long-term growth. “Those investors may find themselves falling behind, because worries kept them out of a relatively good environment,” he says.

“Relatively good” might be an apt description for the current economic environment. US companies generally experienced better-than-expected earnings growth in the second quarter, and analysts expect S&P 500 companies to earn 10% more in 2025 than they did last year.1 Even after recent revisions to job numbers, the job market has been continuing to grow. And unemployment has remained low and relatively stable. “With rising earnings and a steady job market, recession doesn't feel imminent to me,” says Malwal.

Even if the US does eventually encounter a recession, it’s typically no reason to abandon a well-thought-out investment plan. Over long periods the market has historically recovered from recessions and even a depression—often beginning to rally before the economic downturn is even over.

Short-term CDs and Treasurys came into favor among many investors in the past few years as rates rose. Many investors feel comfortable in these investments due to the potential protection they can provide in a down market, their low risk of default, and their predictable cash flows.

There are many wonderful features of short-term investments. But history shows investors with a long-term outlook have often been better off including stocks in their portfolios.

The key challenge with short-term investments is a lack of stronger growth potential. While it’s true that stocks may be more volatile than short-term investments or bonds in the near term, over the long run stocks have provided much higher returns,. Although rates on these investments may appear attractive, they may not be providing much growth after accounting for inflation.

Investors who have time on their side can typically benefit from having a broader exposure to stocks and bonds, or a combination of the 2, as opposed to staying in short-term investments for a long time.

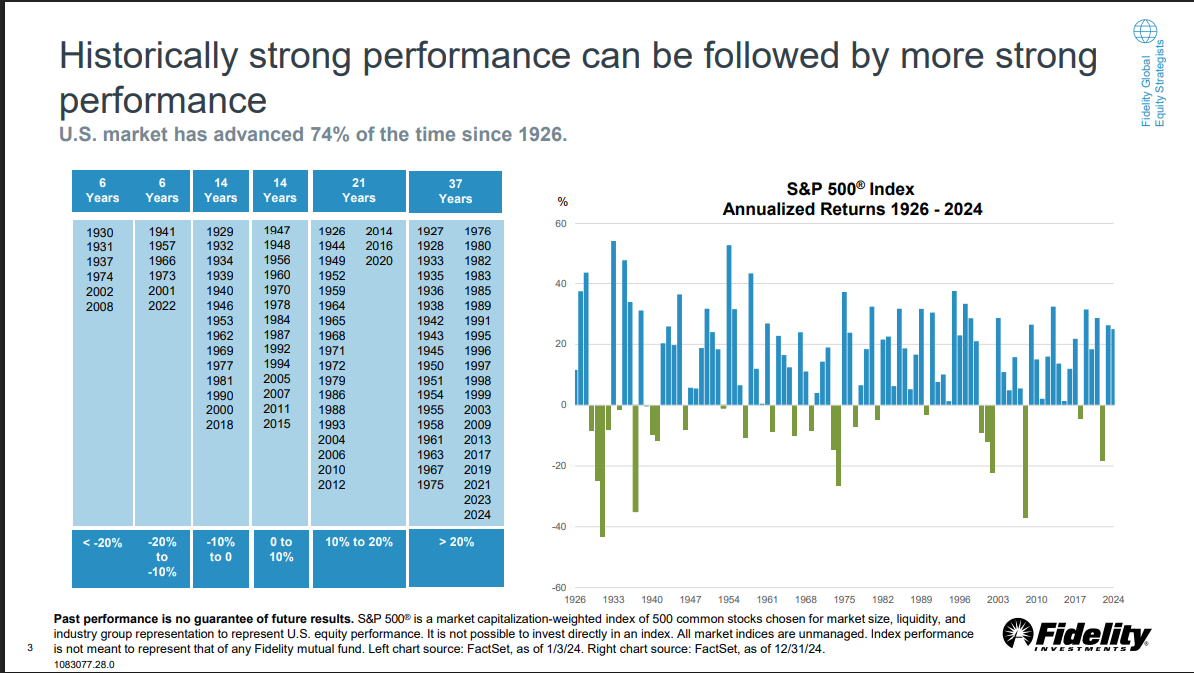

The U.S. market has shown remarkable resilience, advancing 74% of the time since 1926. Historically, strong years for the S&P 500 are often followed by continued positive performance, with most annual returns falling between 0% and 20%. This highlights the market’s long-term strength despite periodic downturns.

The “One Big Beautiful Bill” is projected to provide a strong fiscal boost through 2028, driven mainly by significant tax cuts that outweigh spending reductions. The largest impact is expected in 2026 with a $270 billion net fiscal impulse, gradually tapering off to just $9 billion by 2029, signaling a front-loaded stimulus effect.

While the US Dollar has experienced a declined of 5-10% this year, talks of the its reserve currency status have ramped back up. As always, it's important to check the data. Yes, the US Dollar has depreciated relative to other currencies, but it has done so from an elevated level across all valuation metrics. As shown in the chart, JP Morgan's US Dollar Reserve Currency tracker shows no major deterioration; rather, some measures have actually improved since 2022.

European equities have led global markets in 2025, outperforming other major indexes as easing inflation, resilient corporate earnings, and improving economic sentiment boosted investor confidence across the region.

The rapid expansion of artificial intelligence has become a key driver of U.S. economic growth in 2025, delivering a record contribution to GDP. Accelerated investment in AI infrastructure, productivity gains across industries, and widespread corporate adoption have fueled innovation and efficiency. This surge underscores AI’s transformative role as a structural growth engine for the U.S. economy, reshaping both labor dynamics and long-term competitiveness.

From 2000 to 2025, the U.S. Dollar Index (DXY) has experienced several major cycles, reflecting shifts in global growth, interest rates, and geopolitical conditions. The dollar strengthened sharply in the early 2000s, declined through the mid-2000s with expanding global trade, and rebounded after the 2008 financial crisis as investors sought safety. It reached multi-decade highs in the 2022–2023 period amid aggressive Fed rate hikes and global uncertainty, before stabilizing into 2025. Overall, the dollar has remained resilient, underscoring its role as the world’s primary reserve currency.