CHARTS THAT MATTER

As the old saying goes, a picture is often worth a thousand words. Charts are no exception and often encapsulate a powerful story.

Legacy’s Investment Team flips through hundreds of charts each quarter, handpicking those that we feel are relevant to the particular investment backdrop that you can walk through with us.

Mobile phones have replaced many of our previous everyday items while also increasing individual operating efficiency of users tremendously with their multi-functional nature. This simple, yet informative, graphic also illustrates how technology is a deflationary force over the long term.

This week's chart provides a look at what investors must tolerate in order to receive the premium returns delivered by the stock market over the long term. While it is easy to get caught up in the day-to-day movements of the stock market, focusing on the long-term is paramount as the probability of achieving a positive return increases significantly.

Supply Chain Improvements

The latest ISM Services Index update - utilized to assess the overall health of the broad based services industry in the United States - was released this week and was noteworthy on two fronts. 1) Prices paid fell quite a bit month-over-month, which sparked a brief rally in equities as this bodes well for the inflation outlook. 2) Delivery times have plummeted, as shown in the chart below, which is indicative of very loose supply chain conditions (relative to the backlogs experienced throughout COVID). With inflationary measures in the services sector being the most stubborn component, these metrics bode well for the outlook on inflation and the continuation of the downward trend that we've seen since July 2022.

The Magnificent Seven stocks, comprised of Microsoft, Apple, Amazon, Tesla, Nvidia, Meta and Alphabet, drove a majority of returns in the S&P 500 Index last year, raising concerns from some investors. However, these are also some of the most profitable and cash flow rich companies in the world. And while their valuations are elevated relative to the remaining stocks in the S&P 500, they're still well below prior peaks. In fact, as shown in the chart of the week below, they are currently trading near their average price-to-earnings ratio since 2015.

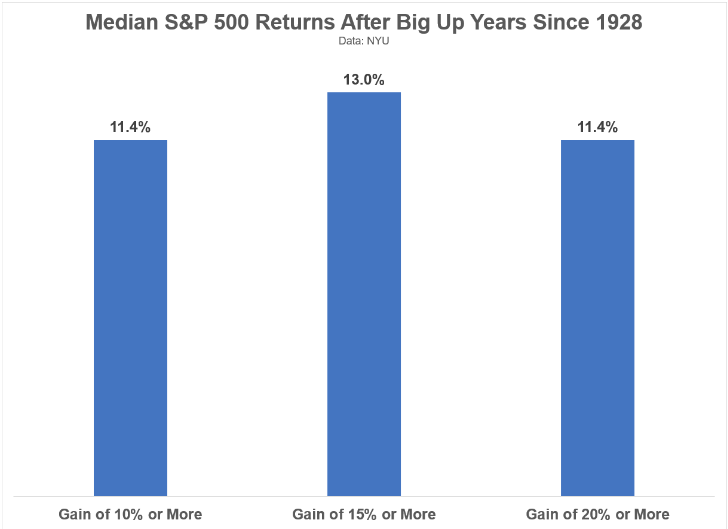

The chart above shows the median returns for the S&P 500 in the ensuing year following gains of 10% or more, 15% or more and 20% or more.

Why It Matters: Many times good returns are followed by good returns but sometimes good returns are followed by losses. The lesson is an especially important one because is shows the futility of making investment decisions based on short-term data. Wise investors focus on the long run and avoid allowing the short run to dictate investment decisions.

Lesson 1: No One Is Very Good at Consistently Getting Market Forecasts Right

The only value in market strategist forecasts is that they show that a wide dispersion of outcomes is possible. The S&P 500 ended 2022 at 3,839.50. The forecasts of 23 analysts from leading investment firms for year-end 2023 ranged from as low as 3,650 (down 5%) to as high as 4,750 (up 24%). The average forecast was for the S&P 500 to end the year at 4,080 (up 6%). It closed the year up 26.4%.

The chart above from Avantis shows that not only is such a wide dispersion of potential outcomes likely, but the median forecast is typically wrong by a wide margin.

The lesson is that investors are best served by following Warren Buffett’s advice on guru forecasts: “We have long felt that the only value of stock forecasters is to make fortunetellers look good. Even now, Charlie [Munger] and I continue to believe that short-term market forecasts are poison and should be kept locked up in a safe place, away from children and also from grown-ups who behave in the market like children.”

Why It Matters: The lesson is an especially important one because investors, like all humans, are subject to confirmation bias. Thus, when we hear a forecast that confirms our own beliefs or concerns, we are more likely to act on it than if we hear a contrary opinion.

The Consumer Price Index (CPI) was unchanged in October, below the consensus expected +0.1%. The CPI is up 3.2% from a year ago - a huge improvement versus the 7.7% reading in the year ending October 2022. The actions taken by the Federal Reserve to fight inflation continue to gain traction.

How have markets historically reacted to geopolitical crisis events, including wars and terrorist attacks? We look back at two dozen or so such events going back to World War II in the table below:

While the total drawdown related to this tragic event and recovery timetable are unknown, based on prior geopolitical events, the average drawdown is -4.7%, while the average time to reach market bottom is 19 days, and the average time to fully recover losses is 42 days. In other words, equities have historically held up well during geopolitical shocks, including wars and other military conflicts going back decades, with the average recovery taking roughly two months. Even the market recovery from 9/11 took only 31 days.

What homebuyers need to know: It’s more expensive than ever to buy a home. The median monthly mortgage payment hit an all-time high of $2,632 during the four weeks ending September 10. Although the weekly average mortgage rate has declined slightly from August’s two-decade high, it’s still sitting above 7%. Prices are up, too, increasing 4% year over year.

What home sellers need to know: Prices continue to rise because inventory is so low, posting one of its biggest declines in 19 months this week. But keep in mind that high prices, elevated rates and the lack of inventory is sending some buyers to the sidelines; mortgage-purchase applications are hovering near a three-decade low and pending home sales are down 12% year over year.

While higher rates are a negative for borrowers, investors and savers have been raving this year about how much they can now earn on their cash. However, investors who deviated from a diversified portfolio have been left scratching their heads as the stock market continues to climb the wall of worry - the S&P is up 18.5% YTD and a diversified 60/40 portfolio is up double digits as well.

Owner's equivalent rent - the official measure of housing price inflation for CPI - is not a real time data point. As shown in the chart below from PGM Global, home prices typically lead the owner's equivalent rent CPI measurement by 18-24 months.

Why It Matters: With this measure just now starting to move lower, this should help inflation continue to tick lower in the coming months.

Abandoning strategic equity allocations may be most tempting at the end of central bank tightening cycles when cash yields reach their most attractive levels. Historically however, exiting the equity market to invest in cash at these inflection points has not provided durable capital appreciation in the longer term. Investors may need to exercise discipline in maintaining target equity weights to achieve long-term return targets.

US housing shortages may provide a cushion to home price declines in 2023. Refinancing activity will likely remain weak given many homeowners’ “golden handcuffs,” which describe existing attractive mortgage rates disincentivizing borrowers from moving homes. For example, less than 2% of conventional borrowers pay more than the current market rate on a 30-year fixed rate mortgage, potentially limiting motivation to refinance even if rates fall.

Based on forward Price/Earnings Ratios, International equity markets are trading at one of the largest valuation discounts relative to the US equity markets on record following their decade+ stretch of underperformance. This is paired with a nearly decade long rise in the value of the US dollar relative to foreign currencies. Cheap equity markets paired with cheap currencies bode well for forward looking returns.

The "excess savings" economists often refer to was driven by a combination of a significant drop in spending and increase in fiscal support during the pandemic. A degree of this "excess savings" has been spent down over the past 1.5 years but continues to be elevated.

Commercial real estate debt as a share of GDP is much smaller than residential mortgage debt thus reducing fears of another financial crisis akin to 2008.

Rental costs still remain below the cost of home ownership, even amid recent improvements in housing affordability. Elevated interest rates and still-lofty home values make ownership pricey. Meanwhile, rent prices on new leases have begun to roll over and will likely become a key driver for lower overall core inflation by year end.

Recent labor market strength has surprised to the upside for 12 consecutive months, revealing a resilient, though gradually softening jobs market. Labor market demand will need to continue normalizing relative to supply to slow wage growth and ultimately bring down core inflation.

March data shows easing energy prices helped pull U.S. headline inflation under 6% for the first time in over a year. However, "stickier" areas of CPI, like service, remain stubbornly elevated.

Over the past 18 months, the Fed has focused predominantly on one problem: inflation. However, recent financial system stress, may have altered policy priorities - or at least the market's perception of them. Over the past few weeks the market implied terminal rate has fallen as investors grapple with how much higher the Fed can hike without any further stress.