Keeping an Eye on the Horizon

This has been a challenging year for investors. On top of the equity bear market, the steep losses in bonds have been especially surprising, leading some to question whether the classic 60/40 portfolio is dead. However, it is important, and especially so during difficult market conditions, for investors to focus not solely on where returns have been but also on where they could be going in the months and years ahead.

This week's highlight article from Dimensional explores the question that is on everyone mind: Does stock/bond diversification continue to make sense? This article builds a strong case for investors to stick with their longer-term plan and should help serve as a reminder that steep declines shouldn’t derail investors’ progress toward reaping the expected benefits of investing.

Dark before dawn

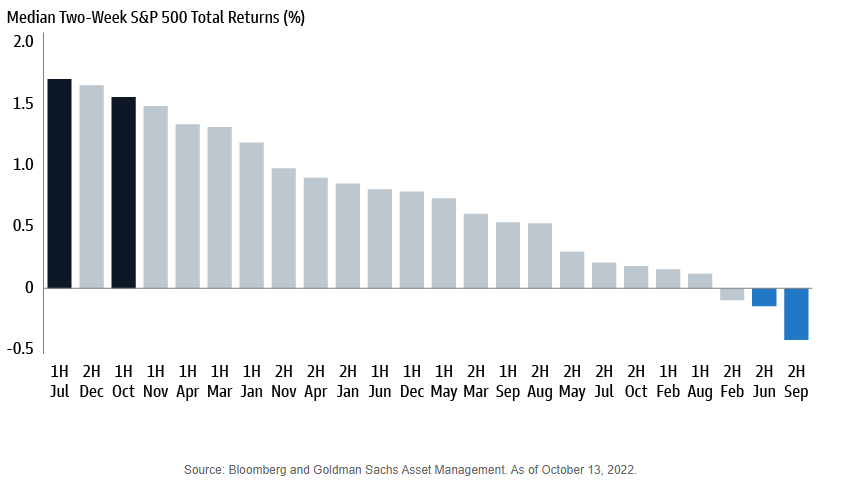

Equity market volatility has historically clustered, leading the best periods in the year to often directly follow the worst periods. Weak equity market performance may continue to reflect fundamental concerns over inflation, monetary policy, currency movements, and a bevy of other factors. Still, being invested at the best days often requires withstanding the worst days, informing our preference to stay the course.

What Else We're Reading

Legacy Trust Family Wealth Offices

4200 Marsh Landing Blvd, Suite 100

Jacksonville Beach, FL 32250

Office: (904) 280-9100

Fax: (904) 280-9109

Legacy Trust Family Wealth Offices of Jacksonville Beach, Florida, is a new type of financial services firm - an independent multi-family office - that brings all facets of your personal financial affairs under one roof, where they are coordinated for optimum efficiency and maximum performance.

Investment products are not FDIC insured, are not bank guaranteed, and may lose value.