Weekly Reading Recommendations

Why Have Yields Moved Higher? (JP Morgan)

Social Media & Money: Follow with Caution (Schwab)

A Look at 2025 Tax Brackets (Fidelity)

2024 Presidential Election and Your Taxes (Fidelity)—————————————————————————————————————————

This Week's Highlight Article

Why the U.S. Dollar Remains the World's Reserve Currency

How likely is it that the U.S. dollar will retain its position as the world’s primary reserve currency in the years ahead? In this week's highlight article, Vanguard’s Roger Aliaga-Díaz, chief economist for the Americas, and Josh Hirt, senior economist, discuss the dollar’s dominance, its widespread use as a reserve currency, and the potential rise of competing currencies.

A few fascinating stats to highlight how dominant the U.S. Dollar is on the world stage include:

The dollar’s role in foreign exchange markets is mostly unchanged over the last 20+ years; in 2022 the dollar accounted for ~89% of all FX transactions. In other words, the dollar was involved on one side or the other in 89% of all global transactions. The dollar’s average turnover per day was $6.6 trillion in 2022, up 14% from $5.8 trillion in 2019 and in line with the change in total turnover.

Part of the reason for the dollar’s dominance in foreign exchange: its use as a medium of exchange in trade and international finance. Around half of all cross-border loans and international debt securities are denominated in dollars. For 65% of all global loan issuance and 88% of all international debt issuance, non-US entities are the issuer/borrower; a clear demonstration of the dollar’s dominance in international finance.

Click Here to Read: Why the U.S. Dollar Remains the World's Reserve Currency

Charts that matter

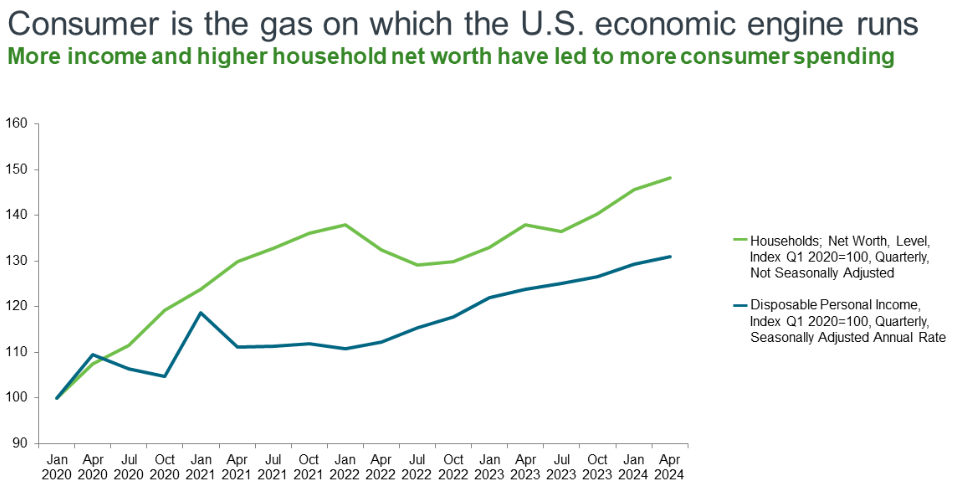

Consumer is the Gas that Fuels the Economy

With household net worth continuing to reach all time highs and wage growth for continuing to exceed the growth rate of inflation, consumer spending has remained far more resilient than anticipated. This strength is set to continue, boding well for economic growth as the consumer accounts for approximately 2/3rds of economic growth in the U.S.

If we equal-weight indexes by giving each constituent company the same percentage regardless of size, it becomes obvious how much a few giant US companies are changing perceptions. What comes as a surprise to many is that on an equal-weighted basis, the total return on MSCI’s index for Europe has actually outperformed its US Index since the beginning of 2023.

Legacy Trust Family Wealth Offices

4200 Marsh Landing Blvd, Suite 100

Jacksonville Beach, FL 32250

Office: (904) 280-9100

Fax: (904) 280-9109

Legacy Trust Family Wealth Offices of Jacksonville Beach, Florida, is a new type of financial services firm - an independent multi-family office - that brings all facets of your personal financial affairs under one roof, where they are coordinated for optimum efficiency and maximum performance.

Investment products are not FDIC insured, are not bank guaranteed, and may lose value.