Weekly Reading Recommendations

Three Reason the Economy Keeps Humming (State Street)

Why It’s a Great Time to Be a Multi-Asset Investor (Morningstar)

For the Stock Market, It’s About Policy, Not Politics (LPL)

Uncertainty is Underrated

For many people, uncertainty is something to avoid or at least mitigate. But what about the positive things that uncertainty can bring? Without it, there would be no surprises, no joy in watching sports, and no 10% average annualized return on the stock market over the past century.

If there was no uncertainty, returns would be predictable and there would be no difference between putting your money in a savings account or investing it in the stock market. Without risk and uncertainty, there would be no reward.

This week we've compiled two great highlight articles, from Dimensional Fund Advisors and Howard Marks, that dive into the positive impact of embracing uncertainty - across both life and investing - and the dangers of certainty.

Click Here to Read "Uncertainty is Underrated"

Further reinforcing how uncertainty is underrated, our second highlight article is from Howard Marks (admittedly, one of our favorite writers in the investment world) in his latest memo called "The Folly of Certainty." Howard explores the dangers of overconfidence in investing and decision-making. He explains how certainty often leads to flawed judgments and emphasizes the importance of acknowledging uncertainty.

Click Here to Read "The Folly of Certainty" by Howard Marks

—————————————————————————————————————————

Charts that matter

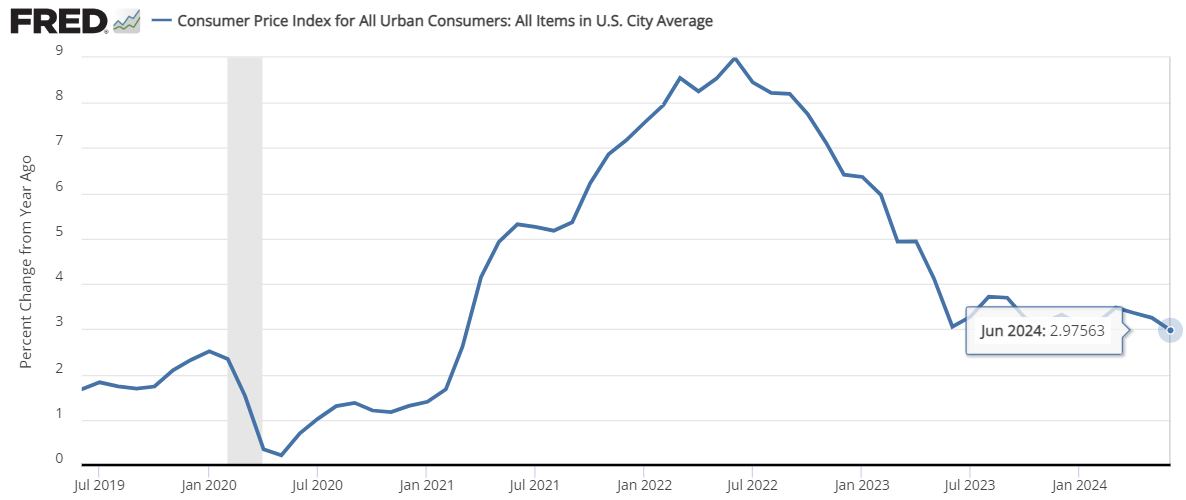

US Consumer Prices Post First Drop in Four Years

The Consumer Price Index (CPI) - a key measure of inflation - fell 0.1% month-over-month in June (the first decline in month-over-month inflation since May 2020!), after remaining unchanged in May. This helped moderate the year-over-year (YoY) CPI to 3% from 3.3% in May, the slowest annualized pace since March 2021.

What to make of this? The easing in headline and core CPI suggests that inflation is trending in the right direction. The broad-based cooldown in CPI combined with the restoration of balance between supply and demand in the labor market supports the view that we are getting closer to a rate cut from the Federal Reserve. Additionally, a continued moderation in inflation should provide some relief to consumers. As long as wages continue to rise at a faster pace than inflation, consumer spending will likely still provide a positive contribution to economic growth in the second half.

If we equal-weight indexes by giving each constituent company the same percentage regardless of size, it becomes obvious how much a few giant US companies are changing perceptions. What comes as a surprise to many is that on an equal-weighted basis, the total return on MSCI’s index for Europe has actually outperformed its US Index since the beginning of 2023.

Legacy Trust Family Wealth Offices

4200 Marsh Landing Blvd, Suite 100

Jacksonville Beach, FL 32250

Office: (904) 280-9100

Fax: (904) 280-9109

Legacy Trust Family Wealth Offices of Jacksonville Beach, Florida, is a new type of financial services firm - an independent multi-family office - that brings all facets of your personal financial affairs under one roof, where they are coordinated for optimum efficiency and maximum performance.

Investment products are not FDIC insured, are not bank guaranteed, and may lose value.