International Earnings Set to Exceed U.S.

Following a decade of underperformance, a new global economic cycle may usher in a resurgent period of outperformance for international equity markets. 2021 may indeed mark the beginning of this rotation – international equity markets stand to benefit the most from the expected surge in global economic growth as reflected through analyst earnings growth expectations for the year.

Housing Demand Shows No Slowing

Home prices have continued their sharp ascent – as millennials continue to enter the housing market, mortgage rates remain attractive, and demand is far outpacing supply with just 1.5 months of home supply on market based on current demand levels

Corporate Guidance Shows Optimism

A record high number of S&P 500 companies have issued positive earnings and revenue guidance for first quarter of 2021 – which should help the trend of earnings growth driving returns.

Leisure & Hospitality Jobs Stage Comeback

U.S. Economy Added 379,000 Jobs in February

The labor market continued to heal in February as the U.S. economy added 379,000 jobs, easily beating the consensus expectation of 200,000 jobs. A particular bright spot within the February employment report was the 355,000 gain in jobs at leisure & hospitality businesses, which shows the waning effects of COVID-19. Given the weather effects in February, the ongoing rollout of the vaccine, and government stimulus programs, look for even faster overall job growth in March.

Why it matters: An increase in jobs translates into greater spending power for consumers and therefore a healthier, faster growing, economy. Greater spending power equates to higher levels of consumption – the backbone of the U.S. economy as consumption accounts for approximately 2/3rds of economic growth.

Path to Herd Immunity

One key variable to the strong economic rebound expected globally in 2021? Herd immunity achieved through natural infection and vaccination . Despite a slow start, the pace of vaccinations in the United States now exceeds 1.25 million per day and growing. At this rate, the United States can approach herd immunity by the 2nd half of 2021. As we approach herd immunity, business and social activities should begin to normalize and a release of pent-up demand by consumers have the potential to contribute to the strongest growth numbers we have seen in years

January Retail Sales

Coming in hot are January retail sales – which posted huge gains and exceeded economist expectations by a wide margin (+5.3% for the month vs. economist estimates at 1.1%). Consumer spending accounts for more than two-thirds of the economy, so knowing how the consumer is faring provides a pretty solid glimpse into where the economy is headed.

Citi's Economic Surprise Index

The US economy – which happens to be in a significantly better position than just about anyone would have expected only 11 months following a global economic shutdown – is still being underestimated as illustrated in the Citi Economic Surprise Index.

Small Cap EPS Forecasts Outpace Rivals

Earnings revisions forecasts for small cap companies (Russell 2000 index – white line) have been dramatically outpacing those of their large cap peers (S&P 500 and NASDAQ). Sentiment may ebb and flow but fundamentals move rather steadily.

Volatility in Perspective

Despite the S&P 500 Index experiencing an average intra-year decline of 14.3%, it has managed to recover and deliver positive returns in 31 of the last 41 years.

Why it matters: Equity markets are volatile and declines are to be expected. The stock market’s ups and downs are unpredictable and nearly impossible to time, but history supports an expectation of positive returns over the long term. For the best shot at the returns the markets can offer, it is important for investors to see through the volatility and stay focused on the long-term.

Small Cap Valuations

Small cap valuations are still attractive relative to their large cap counterparts, even after the recent stretch of outperformance that started in the 4th quarter of 2020.

2021 GDP Growth Projections Rise

Economists continue to raise their economic growth forecasts for 2021 with the International Monetary Fund most recently upgrading their growth forecast for the global economy from 5.2% to 5.5%.

S&P 500 Weighting of Top 5 Stocks

The winners of today doesn’t mean they will be the winners of tomorrow. Maintaining market leadership can be challenging. The 5 largest stocks in the S&P 500 back in 2000 represent just 8% of the S&P 500 today.

Economic Recovery

With the vaccine in route to patients, the economy could return to pre-pandemic levels far sooner than most economists anticipated. The square root shaped (√) recovery appears to be gaining further traction.

The Violent Rotation From Growth To Value

The recent positive vaccine news from Pfizer serves as a boost to value stocks that have been beaten-down throughout the pandemic.

U.S. Job Openings

The number of U.S. job openings climbs back to pre-pandemic levels as the labor market continues to recover.

Recovery in U.S. Real GDP

With historic third-quarter growth, the United States has now recovered two-thirds of the economic output lost due to the pandemic during the first half of the year.

Business Cycle Update

Fidelity Investment’s Asset Allocation Research team, along with several other firms, believes the U.S. as well as many other major economies have progressed out of the recession and entered the early-cycle recovery phase of the business cycle. This bodes well for investors as equity markets have generated some of the strongest returns in the early cycle phase. Nevertheless, bouts of volatility should be expected as we approach the election and navigate the remaining uncertainties with the virus. Portfolio diversification remains critical to success when faced with uncertainty.

The Fastest Bear Market Recoveries

The U.S. equity markets took only 126 trading days to fully recover from the first quarter bear market (defined as a 20% or more decline in prices) – the fastest recovery on record. This also follows the fastest bear market on record as the S&P 500 lost 20% in just 16 trading days during the first quarter. Historically, the faster the decline the faster the rebound and this year is no exception

Staying Invested Matters

Time in the market is far more important than timing the market. By missing some of the market’s best days, investors can lose out on critical opportunities to grow their portfolio and market timing can have devastating results. By missing out on just the 10 best days in the market from 2000 to 2019 – a period that includes two recessions - an investor’s return would have been reduced by more than half. Even more notable is that six of the 10 best days occurred within two weeks of the worst 10 days for the markets! It’s always darkest just before dawn.

Waiting to Buy?

It may never “feel good” to invest new dollars into the equity markets. If markets are hitting new record highs, it may feel better to wait for a pullback before getting into the markets. Conversely, if markets have just fallen into correction territory (a drop of 10% or more), it may feel better to wait and see if the markets continue dropping in an attempt to catch the bottom. History reveals otherwise:

• After the S&P 500 index has hit all-time highs, the subsequent one-, three-, and five-year returns are positive, on average.

• After the S&P 500 has fallen more than 10%, the subsequent one-, three-, and five-year returns are also positive, on average.

It is important not to “anchor” your investment decisions based on price levels; recent market performance should not influence the timing of investing.

Economic Data Continues to Exceed Expectations

The equity market rebound since March has been supported by U.S. economic data that not only continues to improve in aggregate, but has also exceeded sell-side estimates for nearly the duration of 2020 as illustrated in the Bloomberg U.S. Economic Surprise Index – a measure of economic data reported vs. economists’ expectations.

Stock Market vs. Economy

The stock market doesn’t need conditions to go from bad to great. Rather, it just needs to see an improvement in conditions. As the economy begins to heal, stocks have rebounded. You can see this clearly looking at a chart of the S&P 500 (white line) vs. initial jobless claims (red line). The stock market bottomed right as the pace of layoffs hit their most intense level, and has been rebounding alongside an ongoing decline in weekly job losses. While jobless claims are only one economic indicator, it does indicate conditions have started to improve.

Labor Market’s Surprise Strength

Despite more than 9 million new claims for unemployment insurance in May, the U.S. economy added more than 2.5 million jobs in May versus the expected decline of 7.5 million. The 2.509 million jobs print was the strongest monthly gain on record and followed April’s decline of 20.687 million, which was the worst print in the history of the data, which dates to 1939.

Equity Market Rebound

Through May 20th, the S&P 500 posted the second strongest 40-day rally on record, just behind the return posted off the March 2009 lows coming out of the Great Financial Crisis.

US Savings Rate

The US savings rate increased by the highest percentage in 39 years. U.S. incomes fell in March but not as much as spending did – leading to a substantial increase in savings rates. The question is whether or not households will boost consumption when lockdown eases – or be driven by fear and continue to save after realizing they were not equipped to get through this situation.

Tech Dominance in S&P 500 Earnings

Some concern has been noted regarding the dominance of Tech in the S&P 500 – in terms of performance and also in weighting as the top 5 names account for 21.1% of the S&P 500 market cap. Looking at the earnings power of these 5 companies, however, reveals a picture that justifies high weighting as they account for approximately 16% of the S&P 500 index by earnings. Strong profits generated by selling products consumers want more now than ever, strong balance sheets, loads of cash, stable cash flows, little debt and solid management teams helps justify their strong performance as well.

Resilience in Emerging Markets

Emerging Market Growth forecasts have proven much more resilient relative to their developed market peers. Not only are their economies expected to post stronger growth rates, Emerging Market government debt as a % of GDP is half that of developed economies. Prospects for emerging markets look bright on a forward looking basis.

Continuing Jobless Claims in Decline

Continuing claims, which measure those individuals collecting unemployment benefits for at least 2 consecutive weeks, continue to gradually improve. For the week ended July 10th, continuing claims were slightly higher than 16 million, but down 9 million since May, indicating the labor market continues to move in a positive direction, albeit slowly.

US Industrial Output Roars Back

The streak of upside economic surprises continues. The June industrial production figures topped economists' forecasts, as factory output climbed further.

Europe Keeps Unemployment Rate in Check

Europe has been able to cushion the blow to the labor market through generous furlough programs where governments have provided subsidies to workers for the hours they’re not employed. This allows companies to keep more employees on their payroll without triggering a spike in unemployment. This also allows companies to avoid the costly process of rehiring workers as their economies restart. This is likely a factor in the outperformance of International Developed equity markets relative to the U.S. equity markets over the trailing 2-month period. It will be important to monitor the impact when Europe begins to slowly remove this life support for companies.

Economic Data Exceeding Expectations

The Citigroup Economic Surprise Index continues to reach record high levels as economic data has continued to exceed expectations. The index is a measure of economic data reported versus expectations. Measures above 0 indicate economic data has been exceeding analyst expectations. Hitting new records is supportive of the stock market as economic data continues to trend in the right direction (less bad) and exceed all expectations.

Stock Market Industries Impacted the Most

The following 5 COVID-19 sensitive industries accounted for less than 10% of S&P 500 operating earnings in 2019. Therefore, the direct impact to the stock market is not as significant as some may think.

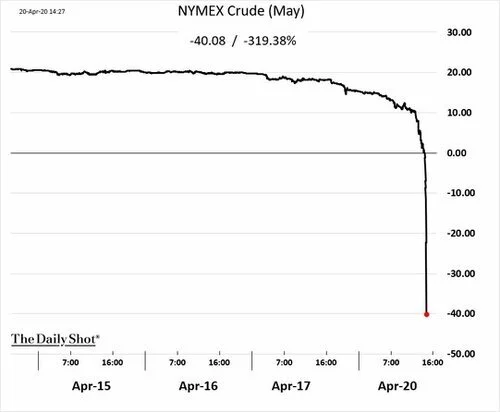

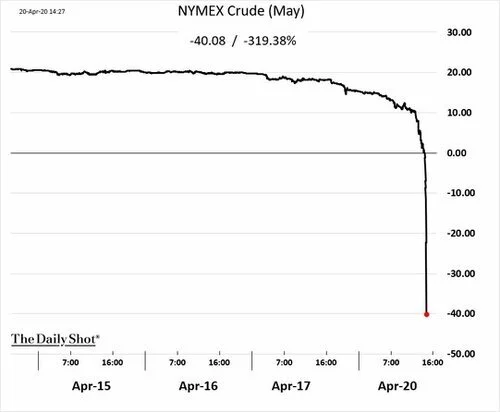

Energy Markets – A Perfect Storm

A glut of supply, demand coming to a hault and storage levels near capacity have driven oil prices to record lows. However, the selloff that reverberated across headlines yesterday was driven more by dislocation in the futures market. The May Futures contract for NYMEX Crude oil, set to expire today, fell deeply into negative territory as nobody wanted to take delivery on the expiring contract. Futures contracts for June held above $20/bbl.

Chinese Economic Growth Crashes

The Chinese economy shrank 9.8% in the first quarter, the worst quarterly reading on record and dragging year-over-year (YoY) growth down to -6.8%, also a record low

Economic Uncertainty

The full roster of second quarter 2020 GDP (gross domestic product) estimates is a brief example of the economic uncertainty posed by the coronavirus. Regardless of which firm is right, the number is going to be ugly. To put in context, the peak-to-trough decline in GDP during the Financial Crisis was -4%.

Jobless Claims Surge

Number of Americans applying for unemployment benefits surged for a second week to reach nearly 10 million over the last two weeks. A record 6.65 million people filed claims nearly doubling the record set the week prior.

Quantitative Easing at Full Speed

The unprecedented speed at which the Fed has purchases securities and injected liquidity into the markets speak to the severity of the situation the economy is facing. The chart below compares the current quantitative easing (QE) program to the QE programs launched during and subsequent to the Great Financial Crisis.

Oil Price Collapse

Price of oil collapses by almost 1/3rd to $30 per barrel as Saudi Arabia launches a price war in response to Russia refusing to cut production.

Flight to Quality

Amid fears of the coronavirus, U.S. Treasuries have benefited from a flight to quality. The 10-year treasury yield has fallen to a new record low (bond prices move inversely with interest rates).

Manufacturing Activity Rebounds

The manufacturing sector continues to show signs of stabilizing following months of slowing down. While manufacturing only represents approximately 12% of economic growth in the U.S., the health of the sector is an important gauge for the overall economy.

Eurozone’s Economy Surprising to Upside

Citi’s Economic Surprise Index for the Eurozone – a measure of where economic data comes in relative to economist expectations – has rebounded sharply over the past few months as reported economic data continues to exceed depressed expectations.

Negative-Yielding Debt Jumps

Following several consecutive months of yields rising on the back of improving economic data, global interest rates have started to retreat as investors pile into safe-haven assets amid fears over the deadly coronavirus spreading from China. According to Bloomberg, the pool of negative yielding debt surged by $1.16 trillion last week – the largest weekly increase since at least 2016 when Bloomberg began tracking the data.

S&P 500 Leaders

The largest tech firms in the S&P 500 accounted for a sizeable portion of the market’s 2019 returns; with Apple contributing over 7% by itself.

Investor Fund Flows

Fund flows can serve as an indicator of investor sentiment. Despite the strong returns in 2019, investors pulled nearly $300 billion from the equity markets in 2019 in favor of money market funds (cash) and fixed income. A sign that this continues to be the most unloved bull market in history.

Global Growth Rebound

The JP Morgan Purchasing Managers Indexes (PMIs) – a measure of economic trends in the manufacturing and services sectors – stabilized heading into year-end. With the reprieve in trade tensions following the phase one trade deal, economic growth appears poised to accelerate through the first half of 2020.