The Consumer & Gas Prices

The consumer is poised to weather the current oil price shock. Household balance sheets and income statements are historically strong. While the price of gasoline breaches new highs, spending on gasoline and other energy goods as a percent of disposable income for the consumer remains below average at 2.3%. While this is set to increase in the coming months, it still has a significant way to go before breaching the highs reached in the prior decade.

Strength of Labor Market

U.S. hiring boomed in February as the economy added 678,000 jobs - exceeding economist forecasts for 423,000 jobs - and the unemployment rate fell to 3.8%. Importantly, the labor force participation rate increased to 62.3% - a welcomed increase as the supply of workers remains constrained. Nevertheless, the labor market still has 1.729 million jobs to add to stage a full recovery from the pandemic-induced recession.

Trends in Strength

The S&P 500 is up 86% of the time in the year following an annual performance of 25% or more. A hawkish Fed and continued COVID related volatility are valid concerns, but being bearish simply because of stellar performance in 2021 historically has been a unfavorable stance.

Value Returns in 2022, So Far

The bars in the chart above show the average year-to-date performance of the stocks in each decile of the Russell 1,000 Index. The stocks with the lowest price to sales ratios are on the left side of the chart, while the stocks with the highest price to sales ratios are on the right side of the chart. As shown, the decile of stocks with the highest price to sales ratios are already down an average of 7.8% so far in 2022. As you move from left to right on the chart, YTD performance gets worse and worse, meaning the higher the price to sales ratio, the worse performance has been. So far in 2022 we've seen a clear trend emerge: investors are selling stocks with high valuations and buying stocks with low valuations.

Rising Rates Historically Coincide Strong Market Returns

Interest rates increased considerably during the quarter, which made many investors nervous. But rising rates historically have coincided with good stock returns—likely because they tend to happen when the economy is strong. Since 1980, gross domestic product (GDP) growth accelerated 60% of the time and stocks gained 82% of the time when the 10-year Treasury yield rose year over year.

2022 Social Security Cost of Living Adjustment

Seniors and other Americans receiving Social Security benefits will see their payments increase by 5.9% in 2022 - their largest annual increase in over four decades - reflecting the cost of living adjustment (COLA) made based on the Labor Departments measure of inflation.

Markets Historically Shrug Off Government Shutdowns

As shown below, equities on average do not react dramatically to budget authority expirations and resolutions. The typical government shutdown since 1980 has lasted just 3 days before a resolution was reached.

Telehealth Here To Stay

COVID disrupted how individuals interact with one another and telehealth is a telling example of the stark shift in human behavior. McKinsey & Company saw telehealth claims peak at almost 80x previous levels in April 2020. The shift to telehealth has remained 38x higher than pre-Covid levels, indicating what is likely the new normal for patient/doctor interaction.

Labor Shortages Amidst Abundant Opportunities

50% of small business owners had job openings they could not fill in August, a record high, according to a National Federation of Independent Business survey. Almost 1/3rd of these small business owners are planning to create new jobs in the next few months, another record high. As additional unemployment insurance benefits fall off in September, significant labor gains may be just around the corner.

The V-Shaped Recovery in Growth

2nd quarter U.S. Gross Domestic Product (GDP) came in at a 6.5% annual growth rate, pushing the economy's size back to pre-pandemic level, as the U.S. finalizes the full "V" shaped recovery. However, the recovery is far from complete as the economy is roughly 2.4% smaller than it would be if COVID never hit and growth trends continued.

COVID Recession Ends

It's official: The COVID recession lasted just two months, the shortest recession in U.S. history to close out the longest expansion on record.

Reopening Sectors Effect on CPI

The price pressures across "reopening" sectors such as airline fares & hotels paired with used auto price increases due to chip shortages continue to have an out-sized effect on inflation. Excluding these sectors, consumer price inflation looks far more subdued.

Consumer Confidence Improves in June Report

The Conference Board’s index increased to 127.3 from an upwardly revised 120 reading in May, marking a new post-pandemic high. The share of consumers that said jobs are plentiful increased to a 21-year high of 54.4%

The Not So Lost Decade

The investment period from 2000 to 2009 is often referred to as "the lost decade." This can be understood from the perspective of investors in the S&P 500, however their experience was not representative of the global asset class opportunity set. When we expand the opportunity set to include U.S. small-cap stocks, International stocks and other asset classes, we can see that the decade was not lost, and that investors with diversified portfolios across multiple asset classes experienced investment exposures with significant positive returns.

Over this period, the S&P 500 posted a cumulative loss of -9.1% while Emerging Market stocks and Investment Grade Bonds posted cumulative gains of more than 154% and 84%, respectively.

The Trouble with Market Timing

Bloomberg data show that 15 of the 22 most popular US market timing indicators have lost money so far this year. All have underperformed a buy and hold strategy.

U.S. Economy Adds 559,000 Jobs in May

The U.S. economy added 559,000 jobs in May to bring the unemployment rate down to 5.8%. However, there is still a lot of room before the job market stages a full recovery - with the broader U-6 unemployment rate remaining in double-digits at 10.2% and 7.6 million jobs less than pre-pandemic levels. As more than 24 states have moved to end the additional unemployment benefits in June, the economy may add millions of more jobs over the coming summer months.

Economic Data Shows Strength Despite Payroll Miss

Despite a weak Payrolls report, economic data continues to show strength. Bespoke Investment Group's Matrix of Economic Indicators shows that the net number of indicators showing positive momentum hit the highest on record in March.

U.S. Vaccine Rollout Gains Momentum

The U.S. has administered more vaccinations than any other country in the world with just shy of 40% of Americans now having received at least one COVID-19 vaccine dose.

INTERNATIONAL EARNINGS SET TO EXCEED U.S.

Following a decade of underperformance, a new global economic cycle may usher in a resurgent period of outperformance for international equity markets. 2021 may indeed mark the beginning of this rotation – international equity markets stand to benefit the most from the expected surge in global economic growth as reflected through analyst earnings growth expectations for the year.

HOUSING DEMAND SHOWS NO SLOWING

Home prices have continued their sharp ascent – as millennials continue to enter the housing market, mortgage rates remain attractive, and demand is far outpacing supply with just 1.5 months of home supply on market based on current demand levels

CORPORATE GUIDANCE SHOWS OPTIMISM

A record high number of S&P 500 companies have issued positive earnings and revenue guidance for first quarter of 2021 – which should help the trend of earnings growth driving returns.

LEISURE & HOSPITALITY JOBS STAGE COMEBACK

U.S. Economy Added 379,000 Jobs in February

The labor market continued to heal in February as the U.S. economy added 379,000 jobs, easily beating the consensus expectation of 200,000 jobs. A particular bright spot within the February employment report was the 355,000 gain in jobs at leisure & hospitality businesses, which shows the waning effects of COVID-19. Given the weather effects in February, the ongoing rollout of the vaccine, and government stimulus programs, look for even faster overall job growth in March.

Why it matters: An increase in jobs translates into greater spending power for consumers and therefore a healthier, faster growing, economy. Greater spending power equates to higher levels of consumption – the backbone of the U.S. economy as consumption accounts for approximately 2/3rds of economic growth.

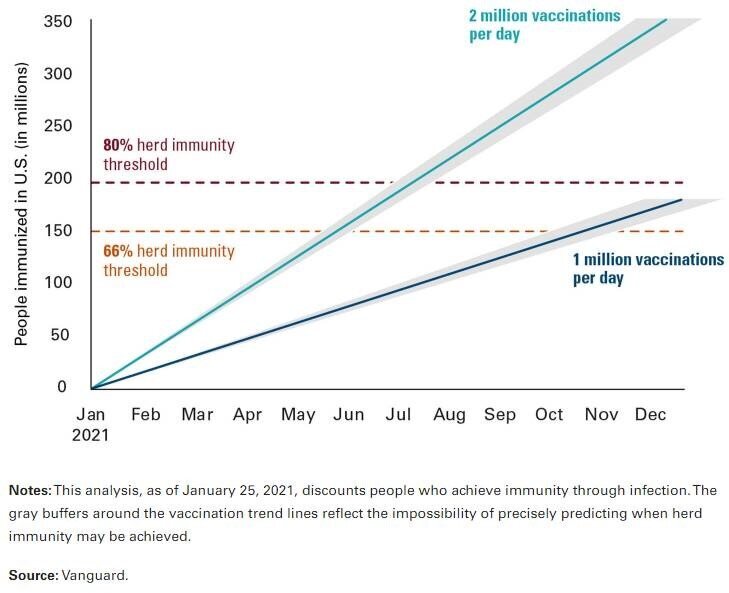

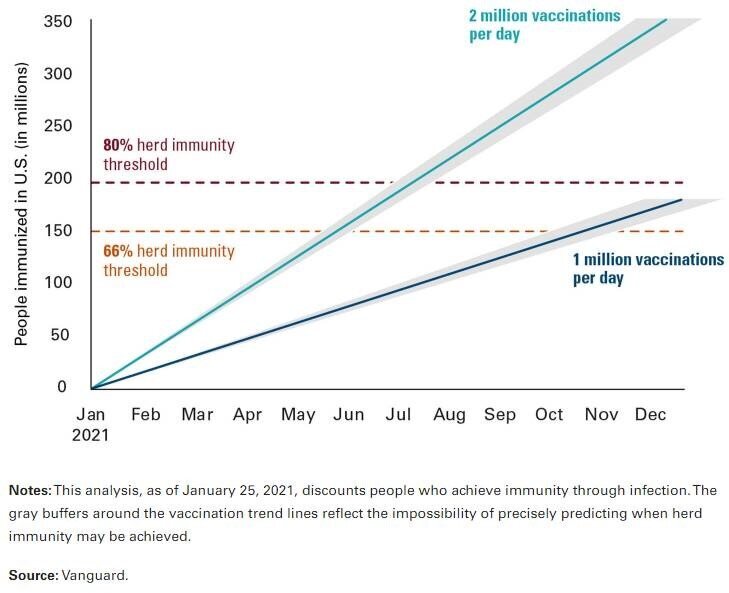

PATH TO HERD IMMUNITY

One key variable to the strong economic rebound expected globally in 2021? Herd immunity achieved through natural infection and vaccination . Despite a slow start, the pace of vaccinations in the United States now exceeds 1.25 million per day and growing. At this rate, the United States can approach herd immunity by the 2nd half of 2021. As we approach herd immunity, business and social activities should begin to normalize and a release of pent-up demand by consumers have the potential to contribute to the strongest growth numbers we have seen in years

JANUARY RETAIL SALES

Coming in hot are January retail sales – which posted huge gains and exceeded economist expectations by a wide margin (+5.3% for the month vs. economist estimates at 1.1%). Consumer spending accounts for more than two-thirds of the economy, so knowing how the consumer is faring provides a pretty solid glimpse into where the economy is headed.

CITI'S ECONOMIC SURPRISE INDEX

The US economy – which happens to be in a significantly better position than just about anyone would have expected only 11 months following a global economic shutdown – is still being underestimated as illustrated in the Citi Economic Surprise Index.

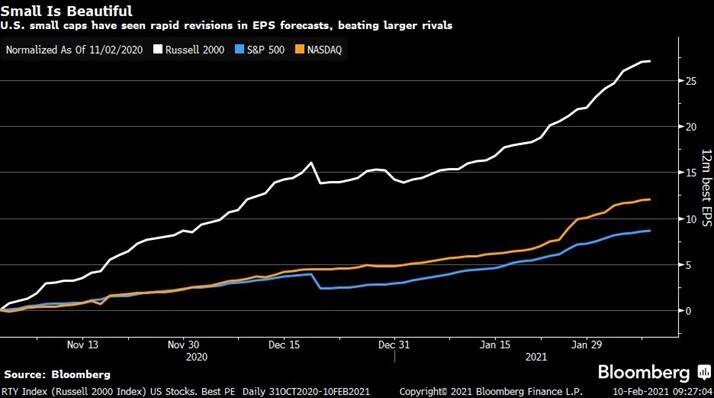

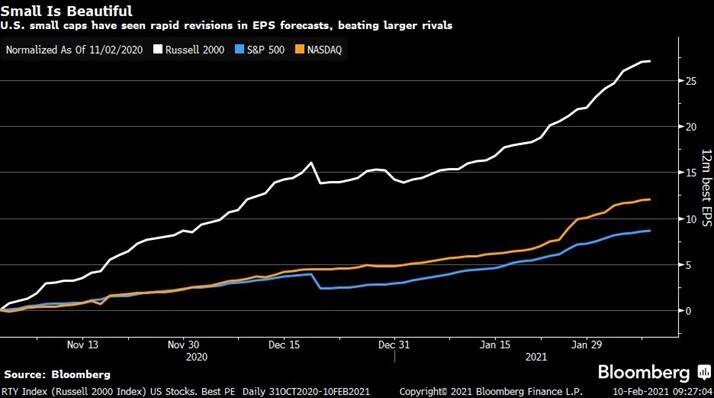

SMALL CAP EPS FORECASTS OUTPACE RIVALS

Earnings revisions forecasts for small cap companies (Russell 2000 index – white line) have been dramatically outpacing those of their large cap peers (S&P 500 and NASDAQ). Sentiment may ebb and flow but fundamentals move rather steadily.

VOLATILITY IN PERSPECTIVE

Despite the S&P 500 Index experiencing an average intra-year decline of 14.3%, it has managed to recover and deliver positive returns in 31 of the last 41 years.

Why it matters: Equity markets are volatile and declines are to be expected. The stock market’s ups and downs are unpredictable and nearly impossible to time, but history supports an expectation of positive returns over the long term. For the best shot at the returns the markets can offer, it is important for investors to see through the volatility and stay focused on the long-term.

SMALL CAP VALUATIONS

Small cap valuations are still attractive relative to their large cap counterparts, even after the recent stretch of outperformance that started in the 4th quarter of 2020.

2021 GDP GROWTH PROJECTIONS RISE

Economists continue to raise their economic growth forecasts for 2021 with the International Monetary Fund most recently upgrading their growth forecast for the global economy from 5.2% to 5.5%.